Legal Notice 139 of 2025 was issued on 15 July 2025 and it amends the Income Tax Management Act to ease certain compliance requirements for both existing and newly incorporated companies that meet specific criteria.

In this article, we are summarising the main provisions and conditions set out in Legal Notice 139 of 2025:

Existing Companies

Reduced Audit Requirements

With effect from 1 January 2025, companies registered in Malta excluding regulated companies, which satisfy the criteria under article 185(2) of the Companies Act (Cap. 386) may benefit from reduced audit requirements, as detailed below:

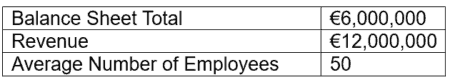

The thresholds which should not be exceeded for 2 consecutive periods under Article 185 (2) of the Companies Act are as follows:

- Companies satisfying 1 out of 3 criteria: A full statutory audit is required;

- Companies satisfying 2 out of 3 criteria: A review engagement in line with ISRE 2400 (Revised) is required; and

- Companies satisfying 3 out of 3 criteria: No audit is required. However, companies are still required to prepare and submit their unaudited financial statements.

Consolidated Financial Statements

A parent company can also benefit from the reduced audit requirements described above if the group forms part of a small group in accordance with Article 185 (5) of the Companies Act.

Shipping Companies

The same exemptions are granted to companies registered under the Merchant Shipping Act. (Cap. 234) if they satisfy the thresholds listed under regulation 64 of the Merchant Shipping Regulations. In this case the applicable thresholds which should not be exceeded for 2 consecutive periods are:

Newly incorporated companies

With effect from 1 January 2024, newly incorporated companies could benefit from the following provisions:

Audit Exemption

Newly incorporated companies may benefit from an audit exemption for their first two accounting periods, provided the following criteria are met.

- The company is owned by individuals;

- These individuals hold academic qualifications at MQF Level 3 or higher, as recognised by the Malta Qualifications Recognition Information Centre;

- These individuals set up the Company within 3 years from obtaining the above-mentioned academic qualifications; and

- The Company’s annual turnover does not exceed €80,000, or a proportionate amount in the case of a shorter accounting period.

Tax Deductions

Qualifying companies that are eligible for the above exemption but still opt to undertake the audit, may claim a tax deduction equal to 120% of the audit fee for the first 2 accounting periods.

Such deductions are capped at €700 for each financial period.

Disqualification

If the company’s shareholding changes such that not all the shareholders meet the criteria described within the ‘Audit Exemption’ section above, the audit exemption and tax deductions cease to apply immediately.

How Can We Help?

At DFK Malta, we understand that navigating through the different requirements can be complex. That’s why we’re here to offer our expertise and support every step of the way.

Our team of experienced professionals is ready to guide you through all the applicable requirements and assist you throughout the process to ensure that all deadlines are met!

*This article is being published for information purposes only and it does not constitute, nor should it in anyway be interpreted or construed to constitute legal advice or guidance. DFK Malta does not accept responsibility or liability for any damages arising as a result of this information being used as legal advice or guidance.