The new Malta Enterprise Invest scheme aims to sustain the regional industrial and economic development of Malta by facilitating initial investments through the setting up of new establishments, expansion of existing facilities, and diversification of existing businesses. Support may be awarded through loan guarantees, interest rate subsidies, cash grants, and tax credits. The support is aimed at facilitating access to funding and accelerating the return on investment.

The project is applicable until the 31st of December 2023.

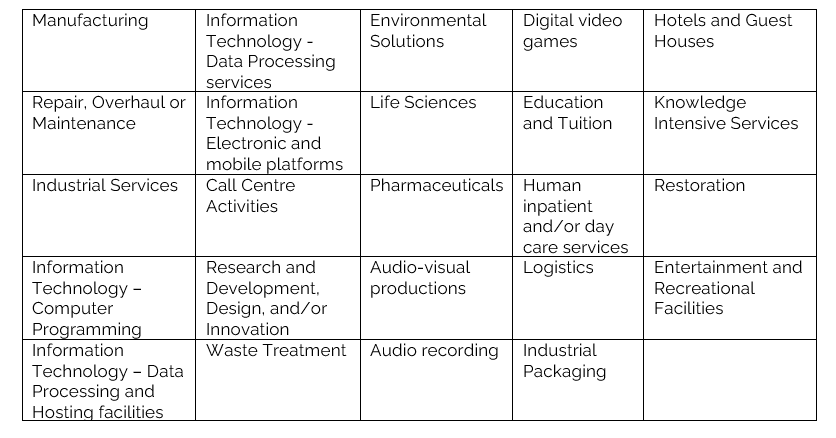

This newsletter focuses on the latest investment scheme which aims to entice SMEs and Large enterprises to invest in their own companies, which will promote new economic activity. Investing activities that are eligible for this scheme are listed as follows:-

Eligible Projects

Support may only be awarded in respect of eligible investment projects commencing on or after 1 May 2022 and by 31 December 2026 or later if the start of works was delayed due to factors outside the control of the beneficiary as shall be determined by the Corporation if the beneficiary applies for assistance by the 31st of August 2023.

Eligible investment projects having a start of works after the 1st of May 2022 but prior to the approval of the Corporation may only be awarded aid in the form of tax credits.

The beneficiary must provide at least 25% of the eligible costs from own resources or external finances without the aid of public support.

Investment Costs related to research infrastructures, energy generation (including renewable sources), distribution, and infrastructure, shall not be considered eligible.

Project Requirements

Small & Medium Enterprises may be supported in carrying out ‘initial investment’ projects consisting of an investment in tangible and intangible assets related to the setting-up of a new establishment, extension of the capacity of an existing establishment, diversification of the output of an establishment into products not previously produced in the establishment or a fundamental change in the overall production process of an existing establishment.

Large enterprises may only be supported in carrying out ‘initial investment in favour of new economic activity consisting of an investment in tangible and intangible assets related to the setting up of a new establishment, or to the diversification of the activity of an establishment, under the condition that the new activity is not the same or similar activity to the activity previously performed in the establishment.

Eligible Project Expenditure for Tangible Assets:-

- The tangible asset acquired must be new or not been previously used in Malta.

- Motor Vehicles bought must be required to conduct economic activity for the company.

- Lease of Tangible Assets may only be considered if the lease agreement contains an obligation for the beneficiary of the aid to purchase the asset upon expiry of the term of the lease.

- Land & Buildings bought must be required to conduct economic activity for the company and is considered eligible for the scheme if the premises was acquired through cost of procurement or leasing of land & buildings. Costs incurred prior to the approval of an application can only be supported through tax credits.

Eligible Project Expenditure for Intangible Assets:-

Patents, licences, know-how, or other intellectual property costs shall be considered for the calculation of investment costs if they fulfill all the following conditions:-

- are used exclusively in the establishment receiving the aid,

- regarded as amortisable assets,

- purchased under market conditions from third parties unrelated to the buyer,

- included in the assets register of the undertaking receiving the aid

Calculating the value of the investment on the basis of jobs created:

- Wage costs of full-time jobs are directly created as a result of the project.

- New jobs created by the investment project will need to be compared with the average over the previous 12 months, meaning that any jobs lost during that period must be deducted from the apparent created number of jobs.

- Wage costs of new employees that had been employed with a linked undertaking in the 6 months prior to the start of the engagement shall not be considered eligible.

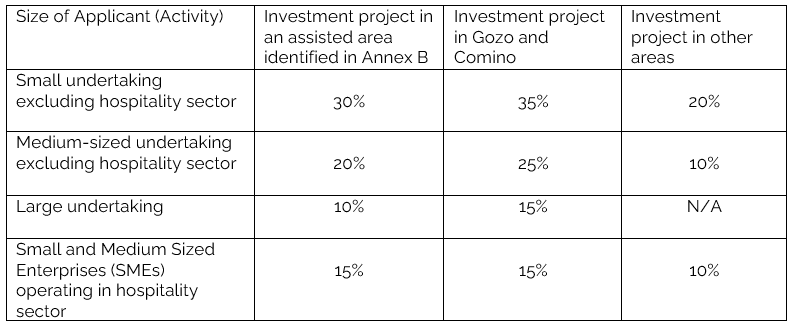

Maximum Support

The total amount of aid for a given investment project shall not exceed the maximum intensities established in the table below:

This article reflects the guidelines published by Malta Enterprise as of 21 June 2022.

For further information contact:

Roberto Sammut Mark Baldacchino

Senior Accounts Manager Accounts Senior

E: roberto.sammut@dfkmalta.com E: mark.baldacchino@dfkmalta.com

*The objective of this summary is to outline the principal elements of the rules being summarized herein. Accordingly, it is not intended to be provided by way of comprehensive and definitive advice. Readers should seek professional advice by contacting DFK Malta Tax & Consultancy Limited before acting upon any information included in this document.