As part of the government’s budget release for 2026, a range of new payroll measures have been outlined that will impact both employers and workers. The updates focus on revisions to income tax thresholds, planned wage rate increases, and changes to statutory contributions such as pensions and social insurance.

Below you can find a summary of the payroll adjustments that will take place as from 1st January 2026.

Cost of Living Adjustment

Full Timers: Eur 4.66 per week

Part Timers: Eur 0.12 per hour

Minimum Wage

Aged 18 years and over - € 229.44 per week

Aged 17 years - € 222.66 per week

Aged below 17 years - € 219.82 per week

Public & National Holidays for the year 2026:

Thursday, 1st January

Tuesday, 10th February

Thursday, 19th March

Tuesday, 31st March

Friday, 3rd April

Friday, 1st May

Sunday, 7th June

Monday, 29th June

Saturday, 15th August

Tuesday, 8th September

Monday, 21st September

Tuesday, 8th December

Sunday, 13th December

Friday, 25th December

New Year's Day

Feast of St Paul's Shipwreck

Feast of St Joseph

Freedom Day

Good Friday

Workers' Day

Sette Giugno

Feast of St Peter and St Paul

Feast of the Assumption

Victory Day

Independence Day,

Immaculate Conception

Republic Day

Christmas Day

Vacation Leave Entitlement

An employee with a 40-hour working week is entitled to 216 hours of paid annual leave; that is, 192hrs basic leave entitlement + 24hrs, in lieu of the 3 Public Holidays that fall on weekends. This is calculated on the basis of a 40-hour working week, and an 8-hour working day. If the average normal hours (excluding overtime) calculated over a period of 17 weeks is below or exceeds 40 hours per week, the vacation leave entitlement in hours should be adjusted accordingly, as provided for in the Organisation of Working Time Regulations. When an employee is in employment for less than 12 months, s/he shall be entitled to a proportionate amount of annual leave.

It is only possible to carry forward up to 50% of the annual leave entitlement to the following year if there is an agreement with the employer. Such vacation leave carried forward from the previous year shall be utilised first and may not be carried forward again.

Unless otherwise agreed to in any applicable collective agreement, the employer may utilize up to the equivalent in hours of twelve working days from the annual leave entitlement for the purposes of any type of shutdown.

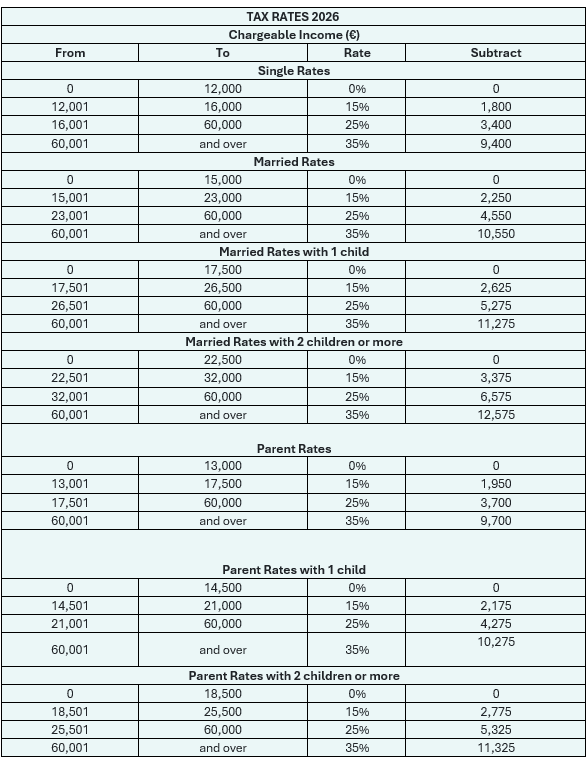

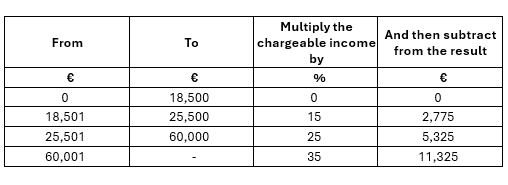

Tax Rates

As announced in the 2026 Budget Speech, new tax rates will come into effect on 1st January 2026 for families with one child and for families with two or more children. The purpose of this communication is to outline the current tax brackets, the new tax brackets, and the applicable conditions.

Further Tax Details below:

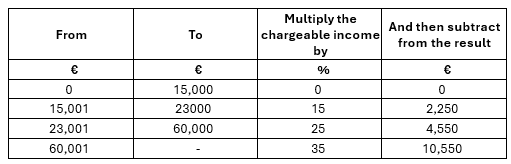

1. Married Couples (Article 56(1)(a))

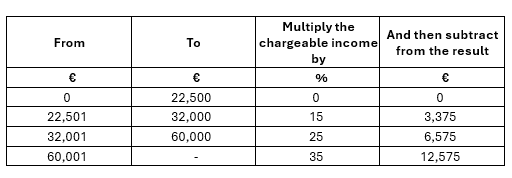

1.1 Standard Married Rates

The current married tax rates will continue to apply to married couples’ resident in Malta who do not qualify for the new rates described in 1.2 and 1.3 below.

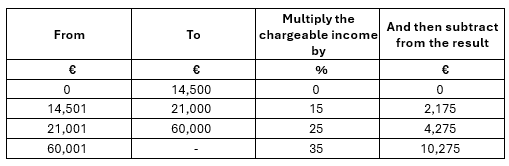

1.2 New Married Rates with One Child

The new married rates apply to married couples’ resident in Malta who maintain under their custody one child who is not over 18 years of age (or not over 23 if in full-time education).

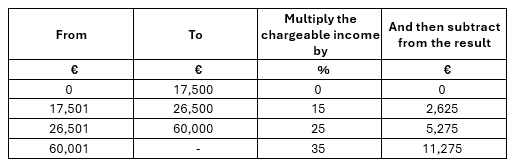

1.3 New Married Rates with Two or More Children

These new married rates apply to married couples’ resident in Malta who maintain under their custody two or more children who are not over 18 years of age (or not over 23 if in full-time education).

It is to be noted that the new married rates referred to in 1.2 and 1.3 shall only apply where, besides fulfilling the condition that the married couple is resident in Malta:

- at least one spouse is a national of Malta or another EU/EEA member state; or

- at least one spouse is a long-term resident of Malta as defined in the Status of Long-Term Residents Regulations and the child is born in Malta and is resident in

In the case of an EU/EEA married couple, where one spouse is non-resident, the above rates may apply if at least 90% of their worldwide income is derived from Malta and all other conditions are satisfied.

2. Single rates/Parent Rates (Article 56(1)(b))

2.1 Standard Single Rates

The current single rates shall continue to apply to resident individuals who do not qualify for any other rates.

2.2 Current Parent Rates

The current parent rates shall continue to apply to resident individuals who do not qualify for the new parent rates described below and who maintain under his/her custody (or pays maintenance in respect of) children who are not over 18 years of age (or not over 23 if in full- time education).

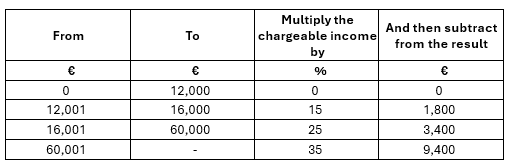

2.3 New Parent Rates with One Child

The following new parent rates shall apply to a parent who maintains under his/her custody (or pays maintenance in respect of) one child who is not over 18 years of age (or not over 23 if in full-time education).

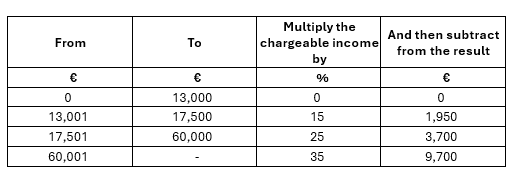

2.4 New Parent Rates with Two or More Children

The following new parent rates shall apply to a parent who maintains two or more children under his/her custody (or pays maintenance in respect of) two or more children who are not over 18 years of age (or not over 23 if in full-time education).

2.5 Married Rates Applicable to Single Individuals

Individuals who are unmarried, widowed, divorced, or separated de jure or de facto, and who maintain under their sole custody a child who is not over 18 years of age (or not over 23 if in full- time education), or who is incapacitated by infirmity from maintaining themselves and is not in receipt of income exceeding €3,400 in their own right, may continue to apply the current married rates, if more beneficial, subject to the applicable conditions.

In case of queries, the general public is encouraged to contact the Malta Tax and Customs Administration via email at servizz@gov.mt

Tax on Part-time Work

Tax rate applicable to income from part time work shall be taxed at the rate of 10%.

Tax on Overtime

The maximum qualifying overtime emoluments cannot be more than €10,000 with the relative maximum 15% tax on overtime being €1,500.

Non qualifying overtime or in excess of the €10,000 threshold must be declared under the Main Deduction Method.

Rewarding Long Service

A new employee retention measure has been introduced under the Micro Invest Scheme, designed to reward long-serving employees and promote wage progression.

- Employers who raise salaries of employees with 4+ years of continuous service will receive a 65% subsidy of the wage increase for two years (capped at Eur 780 per employee per annum).

- For Gozo based employers, the subsidy increases to 80%, capped at Eur 960 per employee per year.

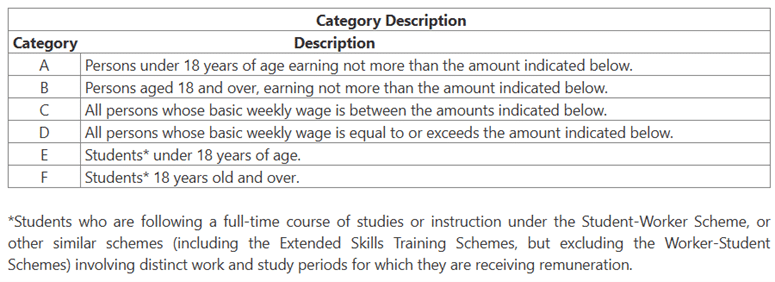

Class One National Insurance Contributions

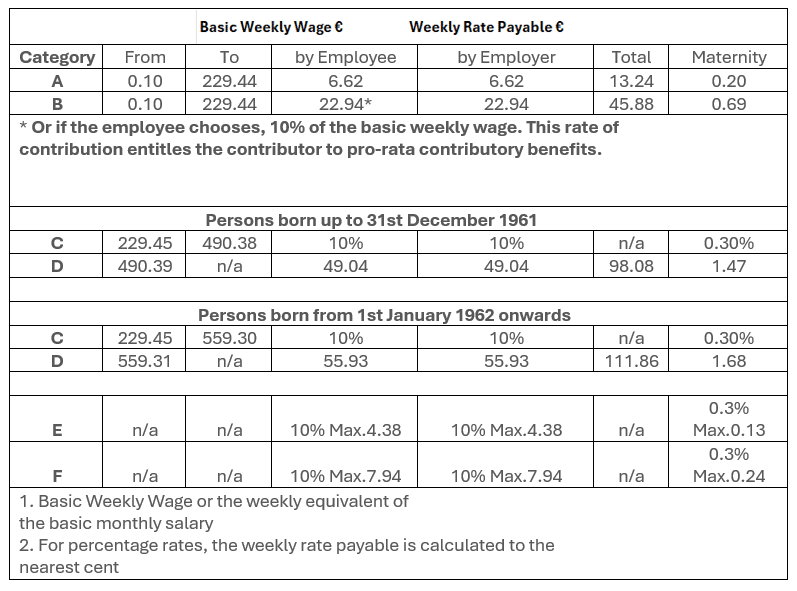

Class Two National Insurance Contributions

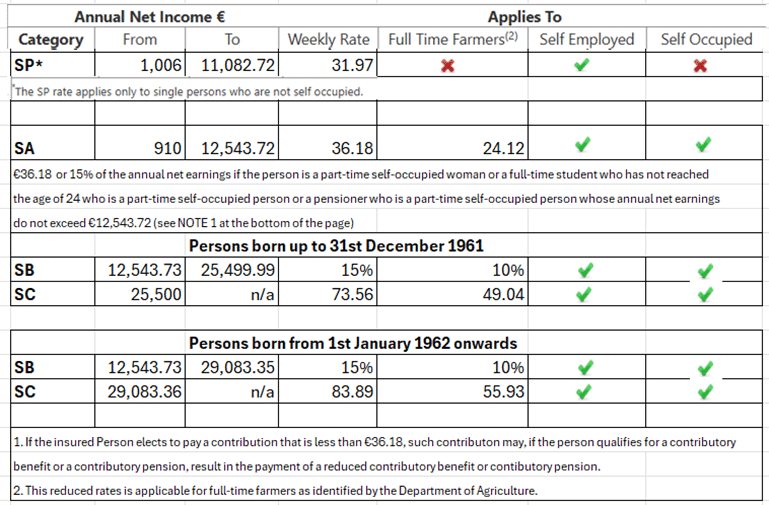

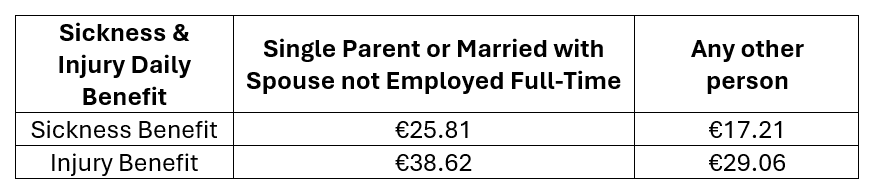

Sickness/ Injury Benefit

Daily rates as from 1st January 2026:

In view of these changes, employers are encouraged to proactively request eligible employees to submit an updated FS4 Form reflecting the new married and parent tax rates.

Acting promptly will help minimise the risk of incorrect tax withholdings and ensure continued compliance with Malta’s payroll and reporting requirements.

DFK Malta remains available to support affected employers in navigating these changes and ensuring they are implemented accurately and efficiently.