Payroll Adjustments For Year 2023

valerie

Array

9 January, 2023

Cost of Living Adjustment

Full Timers: Eur 9.90 per week

Part Timers: Eur 0.25 per hour

Minimum Wage

Aged 18 years and over - € 192.73 per week

Aged 17 years - € 185.95 per week

Aged below 17 years - € 183.11 per week

Public & National Holidays for the year 2023:

Vacation Leave Entitlement

An employee with a 40-hour working week is entitled to 208 hours of paid annual leave; that is, 192hrs basic leave entitlement + 16hrs, in lieu of the 2 Public Holidays that fall on weekends. This is calculated on the basis of a 40-hour working week, and an 8-hour working day. If the average normal hours (excluding overtime) calculated over a period of 17 weeks is below or exceeds 40 hours per week, the vacation leave entitlement in hours should be adjusted accordingly, as provided for in the Organisation of Working Time Regulations. When an employee is in employment for less than 12 months, s/he shall be entitled to a proportionate amount of annual leave.

Unless otherwise agreed to in any applicable collective agreement, the employer may utilize up to the equivalent in hours of twelve working days from the annual leave entitlement for the purposes of any type of shutdown.

Tax Rates

Tax on Part-time Work

The tax rate applicable to income from part-time work shall be taxed at the rate of 10%.

Tax on Overtime Individuals working in a non-managerial position and earning an annual base wage of not more than €20,000 will be taxed at the rate of 15% on their first €10,000 of overtime income.

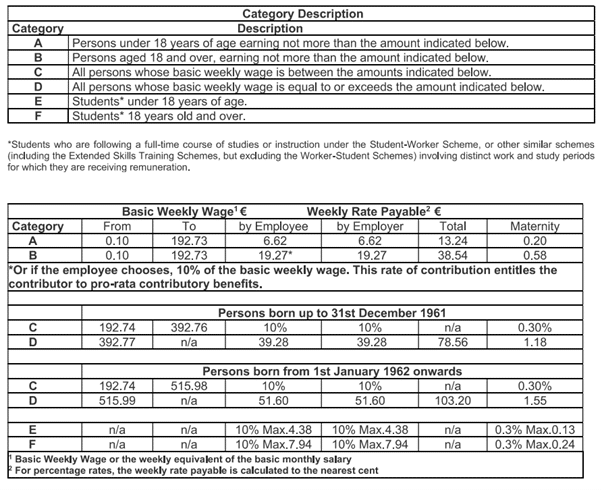

Class One National Insurance Contributions

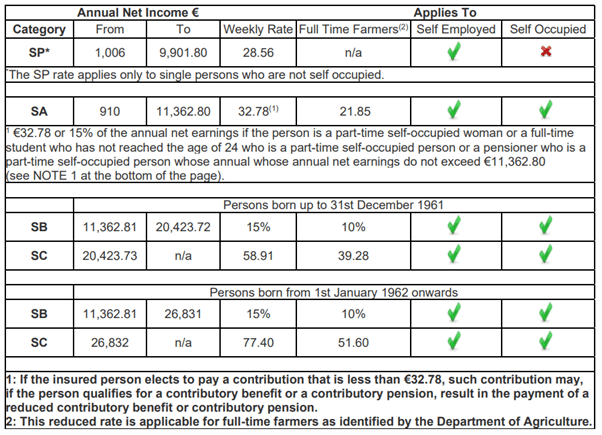

Class Two National Insurance Contributions

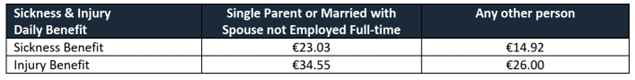

Sickness/Injury Benefit

Submission of Engagement forms and Termination forms to Jobsplus

Manual forms are not being accepted anymore from Jobsplus and effective this year all engagement and termination forms will be submitted online through the Jobsplus portal.

All the clients that have their forms submitted by DFK payroll staff, will be contacted so that they give the authorization to DFK to be able to submit the forms on their behalf. The authorization will be given either with the E-ID certificate or by filling up the delegation of authority form.

Looking for a First-Class Business Consultant?

Get in TouchRelated News

Payroll Adjustments for year 2026

14 January, 2026

Array

Malta’s Simplified Liquidation Procedure enters into force

12 January, 2026

Array

Standards & Awards for SMEs

15 December, 2025

Array

DFK Holiday Closure Announcement!

12 December, 2025

Array

Internationalisation Strategy for SMEs Grant Scheme

4 November, 2025

Array

Malta Budget 2026

27 October, 2025

Array

Support for the Rental and Acquisition of Industrial Space

15 September, 2025

Array

New Audit Exemption Rules

9 September, 2025

Array

Becoming a resident in Malta

29 August, 2025

Array

Important Notice: Office Closure on Friday, 8th August 2025

29 July, 2025

Array